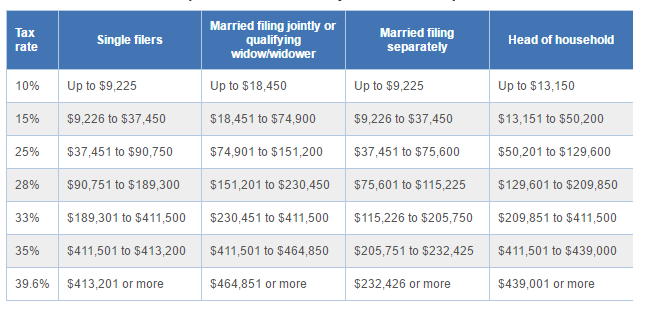

In America, we run on a ‘progressive tax’ system. This means that your tax rate will increase for each dollar that you are making. You won’t be taxed more on your “base amount” but you will be taxed extra for each additional dollar. Let’s say you are making $50k in wages a year for example. While each additional dollar you make will get taxed at 25%, parts of your original $50k will be taxed at 10% and 15%. The table below should explain this relatively well.

While you are in the lower income tax brackets, you won’t be taxed as much. But taxation can become a problem for you once you reach 28%, 33% and even 25% marginal tax. The solution in these cases would require special tax-advantaged strategies that help you avoid having atleast a quarter taken out of every dollar you make.

4 ways to avoid taxation on your investments.

Growth Stock Funds

Instead of putting money into stock funds or stocks that return hefty dividends, and therefore, cause taxation, you can invest in growth stock funds. Growth stocks don’t give dividends and instead reinvests the company’s profits back into the company in hopes of continued and higher growth. This means that the value of your fund can keep growing without you being taxed for a long time. You will usually only get taxed when you sell, triggering capital gain taxes. However, if you are very intentional about when you sell, you can save alot of money in the long-term. For example, selling growth stock funds in retirement when your taxable income will likely be much lower will potentially save you thousands of dollars in taxes.

Municipal Bond Funds

While bonds offer relatively high dividends, the taxation of those dividends is treated just like any other ordinary income. However, if you were to buy public state municipal bond funds, you would be able to get decent dividends while avoiding state and federal taxation. While these bonds can offer great cash flow for high-income earners, it is important to note how inflation may erode the long-term value of the income without a growth hedge.

IRA / 401k

A very common option for many people to save for retirement, putting money away into an IRA (individual retirement account) or a 401k (a type of defined contribution plan) can help save a sizable amount of money from tax. When you contribute to a traditional IRA or 401k, money is taken away from your paycheck before your money is subject to tax and placed into these retirement accounts. This removes sizable money from taxation. With a Roth IRA or 401k, the contributions are taxed immediately but you won’t be taxed on the growth later on. There are disadvantages with these accounts such as not being able to access the money till 59.5 in age or later. However, this can be a great option for most people who should be saving for retirement in the first place anyway.

Tax Loss Harvesting

This is a relatively advanced investing technique. I highly suggest staying away from this unless you really know what you’re doing or if you find a robo-advisor that does this for you. At TFP, our investing partner Betterment For Advisors allows tax loss harvesting for clients.

Tax Loss Harvesting works by selling a security that has suffered a loss, which triggers a capital gains loss. Having a capital gains loss can be a good thing because it offsets capital gains, meaning less taxable income. While you shouldn’t actively search for capital gains loss, being able to take advantage of opportunities when they arise can be profitable. Assuming you don’t collide with wash sales rules which would remove your capital gains loss benefit and assuming that you maintain your asset allocation, this can cause gains with substantial impact in the long run. You could potentially take up to $3000 per year in tax deductions from income with this type of strategy.

These are four ways to avoid taxation on investments.