There’s an ongoing misconception that if you ever did want to achieve financial freedom, that you NEED to own a home. The false idea that if you’re not owning a home, you’re just “throwing your money away”. But who is sending that message in the first place?

It’s the real estate industry that’s primarily selling you this message! And of course, they want you to believe it. They make money when you buy homes. There is a clear incentive for them to tell you that buying a home is always a good decision. They want you to believe if you buy a home, that you will surely be on the path to wealth. Of course there are regular investors out there who will swear by real estate, but there are clear disadvantages and problems that they normally don’t talk about. There are times when real estate makes sense but other times when it doesn’t make sense. I’m going to disprove common misconceptions and show you some numbers.

Home Ownership Is Not Necessarily The Path To Financial Freedom!

Misconception #1: You’re throwing your money away if you’re renting.

This is just plain wrong.

If you own a house, you’re responsible for more than just rent. You need to pay off interest, home insurance, taxes and property maintenance and the closing costs as well. This all means that not only will you be paying the mortgage (which is bundled with payment towards home equity + interest), you’ll be paying towards items that don’t add value to your net worth.

Normally, these extra items such as insurance and taxes will be around 50% more than the mortgage amount. So if it costs $1000 a month for a home mortgage, you can estimate that you will need to budget around $1500 a month for the entire year to cover the miscellaneous costs. But in that scenario, perhaps only $800 is going towards building true equity out of the $1500.

The other side of this: what if you had to sell the house early? If there’s a remote chance that you would need to move in the next 5 years for the following reasons, then don’t buy the house:

- You found a new job at a different location, or your current job forces you to move locations.

- You lost a high-paying job where you’ll never be able to get the same income again.

If you do move early, you will very likely lose money having bought the home. The “5-year rule” for housing says that you shouldn’t buy a home unless you expect to stay there for at-least 5 years. I would push this further. You should be in that home for at-least 7-10+ years before you make a real profit.

To explain why you don’t really make a real profit on the house in the beginning years, it’s because you pay more towards interest on the mortgage in the beginning years. So if the mortgage costs $800 in the first year, it would be fair to say that around 70% ($560) of that goes towards interest and the rest towards building home equity. By year twenty, the payments would be more towards principal payments and less on interest. Considering that renting is often cheaper than housing payments, you could have used the difference towards investments that create higher returns on the money. More discussion on this below.

Misconception #2: You can just buy a duplex (2 unit apartment), rent one out to someone who will pay the bills and you live for free.

I hate this advice, since it’s so naive and misleading. If it was really that easy, then everyone would be doing it. The truth is, in most real estate markets, especially the most competitive places like NYC or Los Angeles, the real estate firms have already scooped up these opportunities. These are professionals who build complex excel sheets on property cash flows and are searching for good deals on a daily basis. What makes you think that as an inexperienced first-time homebuyer that you’re going to be able to beat them on those deals? Those same real estate firms often sell those property “deals” to people at a premium. Most properties that you buy from these crowded markets will come at a cash flow loss to you in the first few years. You’re going to lose more than you make in the beginning.

Misconception #3: The house will appreciate and make me way more money.

In general, housing price increases keeps up with inflation, meaning you’re not actually making any real profit on your “investment”. If you happen to catch a “hot market”, then maybe your housing will outpace inflation by an extra 1-3% per year. But to really be able to bank on that kind of growth, you’d need to have that property for a long time because the housing market is unstable. The housing markets growth is not necessarily a graph where the prices are always going up in a linear fashion. It’s going to go up and down along with the economy. This means that at a certain time, your ability to sell at a profit will not necessarily be guaranteed. This is the same as the stock market, at some point, every asset out there will hit a down point. When you buy a house on the basis that it’s going to keep increasing, or that you can sell it at a gain for 1-5 years, it’s just plain wrong. It’s that kind of thinking that led to the real estate markets collapse in 2007-2009.

The other factor you need to consider are the closing costs. When listing the house for sale, you can expect to pay 5-7% to realtors, lawyers, etc. just to get the house sold. Whatever gains you make past inflation on the house in the short-term could easily be offset by those closing costs.

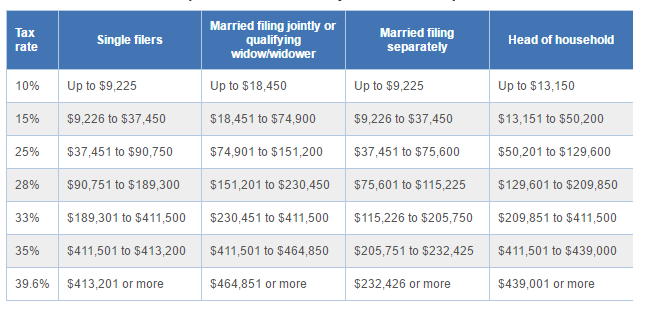

Misconception #4: A house will get you mortgage tax deductions that make everything completely worth it.

This is like looking at everything on a pennies vs dollars basis. If it costs 800 to rent an apartment, and $1500 for all the housing costs on the cheapest house available, and you save even $100-400 on mortgage tax deductions, you’re still paying more than you would have originally, compared to if you just rented and invested the difference.

I’ve been hinting at this, but the other option instead of buying a house, is to rent and invest the difference. Why would that be a better option? Let’s look at the math.

Let’s assume you were trying to purchase a $250k 2-unit house. With a 20% down payment of $50k and an assumption of 1% closing cost for buying, at $2500, you sacrifice an opportunity cost of $52.5k towards this house. Assuming you had an interest rate of 4% on a 30-year fixed mortgage, you’d be paying $955 a month. By factoring an additional 50% to cover the misc costs, you would need to budget $1432 a month.

Let’s also assume that you lived in one unit for “free” while you rented the other unit for 650, about 300 less than the mortgage price. Not bad to have your neighbor pay more than half your mortgage right? Your net loss per month, or essentially your “housing payments”, would be $782, leading to a yearly “rent” of $9390. Let’s also optimistically assume that the house will appreciate every year by 4%, above normal inflation rates of 2-3%. By year 5, the house will have increased from $250,000 to nearly $304k. After having payed 5 years of your bills, you owe $19,104 less on your original mortgage balance of $200k and will have paid $16,950 towards your “rent”. Factoring in the gains/losses of the house’s value appreciation, mortgage payments and debt reduction, you will have a face net gain of $26,318 after those 5 years. This is the kind of number most people look at and pride themselves on when talking about their investment, after the perfect scenario of higher-than-inflation home value increase, non-stop revenue income coming from a well-behaved renter who covers nearly all of the bills, and normal housing costs.

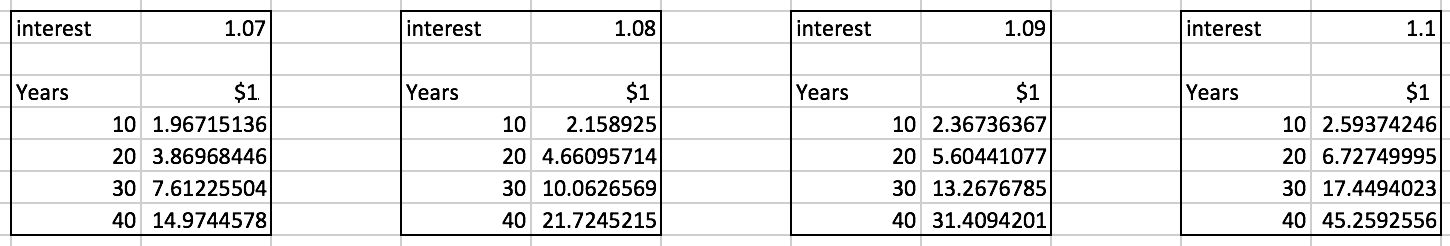

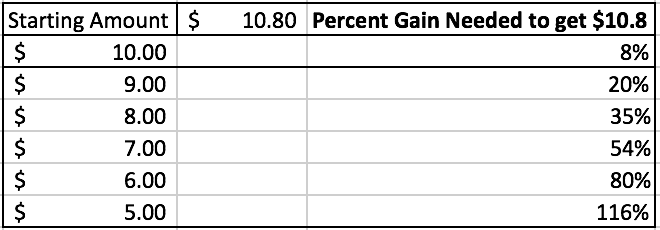

But this is the biggest issue. Remember that $52,500 you put in as a down payment towards the house? When you put that money away into the house, you actually sacrifice an opportunity cost of having been able to direct that money into some other investment. What this means is that instead of having put that $52,500 into the house, you could have just as easily put it into investments that returned a modest 7% on average after 5 years. This means you have lost the opportunity to see an increase of your money by $21,134 in that time. If you subtract that opportunity cost, your overall net gain from buying the house at $250k and selling at $304k 5 years later is around $5,184.

Let’s assume that instead of putting the down payment money into buying a house from the beginning, you had left it inside investments that returned 7% per year. You will also settle for renting a cozy place at $650 and reinvest the difference of $132.50 that would have gone into the mortgage. After 5 years, your money will have appreciated by $31,411. That’s way more than the return your original house would bring you. Keep in mind that you could easily sell portions of your investments away with favorable taxation rates when in need of quick money, compared to being stuck with a lumpy house that you won’t see tangible cash benefit from until sale.

However, this doesn’t mean home ownership is all bad to be fair.

In these instances, home ownership can actually make a lot of sense (but not always).

- You are able to stay in that multiple unit house for more than 7-11+ years. If you can stay past 11 years while renting out a portion of the house to cover the bills, then it will have had a good chance to pass the profit point over normal stock market returns. If you are living in that house without renting a portion to others, it brings you no added income whatsoever, meaning there’s a good chance it never made sense to own that home over investing in the stock market.

- You did the calculations, and you found a house that makes financial sense over the stock market, even if you did sell in less than 5 years. For example, if you come across a “fixer-upper” house that could greatly appreciate in value after it’s worked on. Be warned though, the time spent fixing this house may also be less valuable than working on a different project. You need to factor in your own time spent fixing that house compared to side income that would potentially earn you more.

- It’s psychologically easier for you to pay off a mortgage bill of $280 or whatever amount, than to consistently invest that money away.

- You just like real estate more than the stock market. Whatever your reasons are, you’re just not a fan of the stock market. In that case, you might as well pick any type of investment than none at all. Even if it isn’t the most optimal use of your money, well at-least you’re doing something.

- You’re buying in a hot market. But be warned, this type of thinking where “the house will just keep going up” is what caused the Great Recession in the first place. Many people lost their homes and livelihoods because of this type of optimistic thinking.

If you can meet one of these conditions, then it probably makes sense to aim for a home.

Hopefully you now have a more comprehensive understanding of the kind of thinking that needs to go behind what will likely be one of the biggest purchases, if not the biggest purchase of your life. If you have any questions, feel free to ask.

In the context of investing, leverage means using additional money that’s taken out as a loan to invest into a product that is expected to produce higher returns. If someone takes a bank loan of 4% interest to create a coffee shop that can produce 20% return within the year, they will have made successful use of leverage.

In the context of investing, leverage means using additional money that’s taken out as a loan to invest into a product that is expected to produce higher returns. If someone takes a bank loan of 4% interest to create a coffee shop that can produce 20% return within the year, they will have made successful use of leverage.