Compound interest is a term that many have heard often but is rarely well understood. The definition on wikipedia is as listed:

Compound interest – is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest.

Well, that sounds almost simple – the money you make, will make even more money in the future. But what exactly does that mean in practical terms? This may be where most of the confusion comes in from.

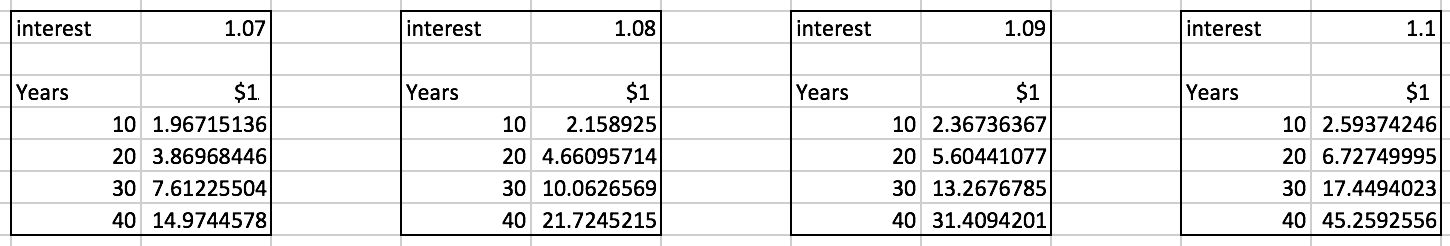

In the above tables, we can see an assumption of different interest rates. These interest rates are tested on the growth of just $1 over different decades. What we’ll find is that the one dollar will grow to about $1.96 to $2.59, about double growth in 10 years for 7-10% interest rates. But by the 20th year, the growth is even higher, ranging from $3.86 – $6.72. The most astounding realization is that by the 40th year the dollar becomes $14.97 – $45.25, a 15 to 45 times return.

In effect, we can learn multiple lessons from this short example:

- For every dollar we spend, we are not just losing only a dollar but we are losing all the future potential growth that the dollar would bring.

- The amount of time that the dollar has to grow will have a huge impact. The difference between a dollar thats been invested for 20 years (at $3.86) and 40 years (at $14.97) is extreme. It’s better by a long-shot to have money to invest as early as possible than getting started later.

- Small differences in interest rate assumptions can have a huge impact. Meaning if you are being charged large fees such as the financial industry’s normal of 1%, it can have a huge effect on your long-term gains. Thus, it is important that you assess whether there is a true premium of investment return if others manage your money vs investing the money into index funds.

There is also another large implication as a result of these calculations. If we know that the money can grow by a large amount, even with conservative expectations in long-term growth, then we shouldn’t fret over not being able to grow the “money fast enough”. For many, 7-10% growth per year sounds unexciting and even unreasonable. Why invest if we’re not going to go for the stars while doing so? The problem is that aiming for incredibly high returns is likely to increase the chance of risk as well.

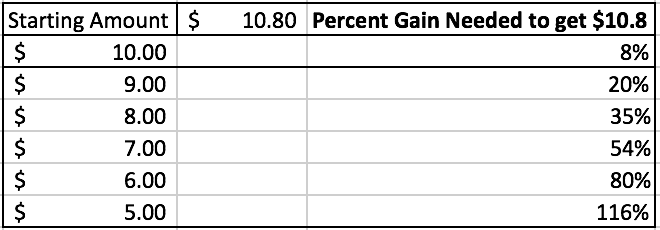

If you look at the above table, there is an assumption that you could start out with $10 and take an 8% return for a comparatively small 80 cents that year. Sounds unexciting right?

Some may feel tempted to aim for much more in their returns. Let’s assume this person took a huge risk and as a result, they take a substantial loss, ranging from 10-50%. That would represent $5 (50% loss) to $9 (10% loss). Now this person will have to achieve incredibly high returns to even achieve the same 8% growth as the relatively conservative investor. This can become a losing cycle because to achieve such high returns in many cases would require high risk bets, which can cause further losses. To avoid such psychologically dire situations, it would have been better to start off relatively conservative from the beginning. Even one major loss after years of relatively strong growth can cause the investment portfolio to do worse than it should have.

If we know in the long-term there will be truly high gains (despite seemingly small returns in the short-term), it will be easier to feel peace of mind as we pursue our goals. It might seem boring to some but it is a better alternative to risky strategies that are unnecessary to achieve long-term goals that most pursue in their life such as retirement.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it. ” – Albert Einstein